Price Forecasting

EES Consulting provides a wide array of forecasting services to clients including load and peak demand forecasting, market prices, and other related independent variables such as population, income, and employment. Forecasting services are often provided as part of other studies such as integrated resource planning, resource analysis, benefit-cost analysis or as a stand-alone service.

We define our clients’ longer term purchase needs through load forecasting using statistical and econometric analysis of consumption patterns and energy efficiency measures. Shorter-term purchase needs are developed from review of historical demands, weather forecasts, spot market prices and existing purchase contract prices and limits. We can plan a resource stack to meet forecasted loads using the lowest cost combination of existing contract purchases, existing supply resources, and short-term market purchases and sales.

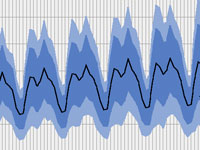

EES Consulting prepares market price forecasts for a variety of uses including resource evaluation, integrated resource planning, benefit/cost analysis, risk analysis, and financial planning. Price forecasts are developed based on a number of inputs or variables including forward price curves, input prices, economic variables, and historic trends. Forecast scenarios can be developed stochastically (Monte Carlo) or deterministically. Examples of electric, gas, CPI, etc., price forecasts include regional natural gas, transportation, electricity, uranium, or coal.

Clark Public Utilities

Clark Public Utilities (CPU) conducts or updates an integrated resource plan every two years. EES Consulting assists not only in the resource modeling but also in preparing fuel price forecasts for each resource (generic or specific). Fuel price forecasts conducted for CPU include electricity prices, natural gas prices, uranium, coal, and biofuels. Deterministic scenarios (low, base, and high price forecasts) were developed to assist in a risk analysis.

Energy Northwest

Energy Northwest asked EES Consulting to develop a forecast of tradable renewable energy credits (RECs) within the Western Electricity Coordinating Council (WECC) region. Compliance REC prices were forecast over a 20-year period given various state renewable portfolio standards, electric load forecasts, renewable resource definitions, current renewable resource capacity, and forecast resource prices. Compliance REC price forecasts are useful in both utility financial planning and resource acquisition strategies.

PNGC Northwest

EES Consulting assisted PNGC, a power purchase cooperative in the Northwest, in evaluating resource options needed to meet load growth above their Tier 1 allocation from the Bonneville Power Administration. The resource evaluation involved stochastic modeling of various electric market price forecasts.