Resource Optimization & Modeling

EES Consulting offers utility system planning services that provide a range of state-of-the-art and cost-effective solutions for electric, gas, water and wastewater utilities and their customers. These services employ statistical, econometric, and operation research techniques to provide cost-effective solutions to utility-oriented problems. These services include:

- Optimization modeling for short-term and long-term forecasting and analysis

- Econometric forecasting and analysis

- Survey design and implementation

- Statistical analysis and evaluation

- Decision analysis

- Risk and probabilistic simulation

- Load and flow research

These services have been used to address a wide range of utility problems, including resource dispatching, integrated resource planning and distribution system sizing.

Imperial Irrigation District

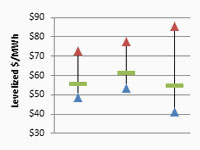

EES Consulting provided a due diligence review of a proposed 50 MW geothermal project to be located in the Imperial Valley. This due diligence review identified and quantified risks and uncertainties related to ownership options, location of the plant, exploration uncertainties, resource development issues, cost estimates, financing options and power supply pricing. The due diligence provided the 30-year expected cost of each scenario analyzed on a levelized dollar per megawatt-hour ($/MWh) of output basis.

PNGC Power

EES was asked to develop a risk analysis for PNGC for new resource options. The study helped PNGC decide how to best access the wholesale electric market via four market based products for a four-year period. Market price forecasts were developed for each product and portfolios were selected and analyzed. Each portfolio consisted of one or more product. A stochastic risk analysis was performed using Monte Carlo simulation for market prices. Deterministic risk elements such as load growth, resource additions, non-power supply costs, and transmission costs were also evaluated. The results of the study were presented using modern portfolio theory which compares the expected costs and a measure of risk for each portfolio.